Latest News

-

The Real Reason Insurance Claims Get Flagged for Investigation

—

Most investors believe that landlord insurance and a standard building policy give them full protection. In reality, insurance risks in rental properties are often misunderstood and only become visible on claim day, when losses are already locked in. Knowing how rental property insurance works, and where it commonly fails, is essential for every owner. Inconsistent…

-

The Insurance Risks Hidden in Rental Properties and Investment Homes

—

Most investors believe that landlord insurance and a standard building policy give them full protection. In reality, rental properties carry unique risks that are often misunderstood. These oversights only become visible on claim day, when the financial damage is already done. Understanding how rental insurance works, and where it fails, is essential for every property…

-

The Biggest Myths About Home Insurance That Cost Australians Money

—

Home insurance feels simple until a disaster hits and the biggest myths about home insurance start costing homeowners real money. Most gaps do not come from fine print. They come from assumptions. If you believe any of the biggest myths about home insurance, you are already carrying risks you cannot see and costs you will…

-

The Power of Proof: Why Documentation Is Your Best Defence

—

When it comes to insurance, what you can prove matters more than what you remember. Strong documentation for insurance claims determines whether payouts are smooth, delayed, or denied entirely. Why Proof Matters The General Insurance Code of Practice (2025) allows insurers to request verification for high-value or recently purchased items. Yet Suncorp’s 2025 Home Claims…

-

After the Storm: How to Speed Up Your Insurance Claim with Better Evidence

—

The hours after a severe storm can be overwhelming. Fallen trees, water damage, and power outages leave homeowners scrambling. But one of the biggest challenges comes later: proving what was lost. This is the key to being able to speed up your insurance claim. Why Claims Stall Allianz (2025) reports that missing documentation and incomplete…

-

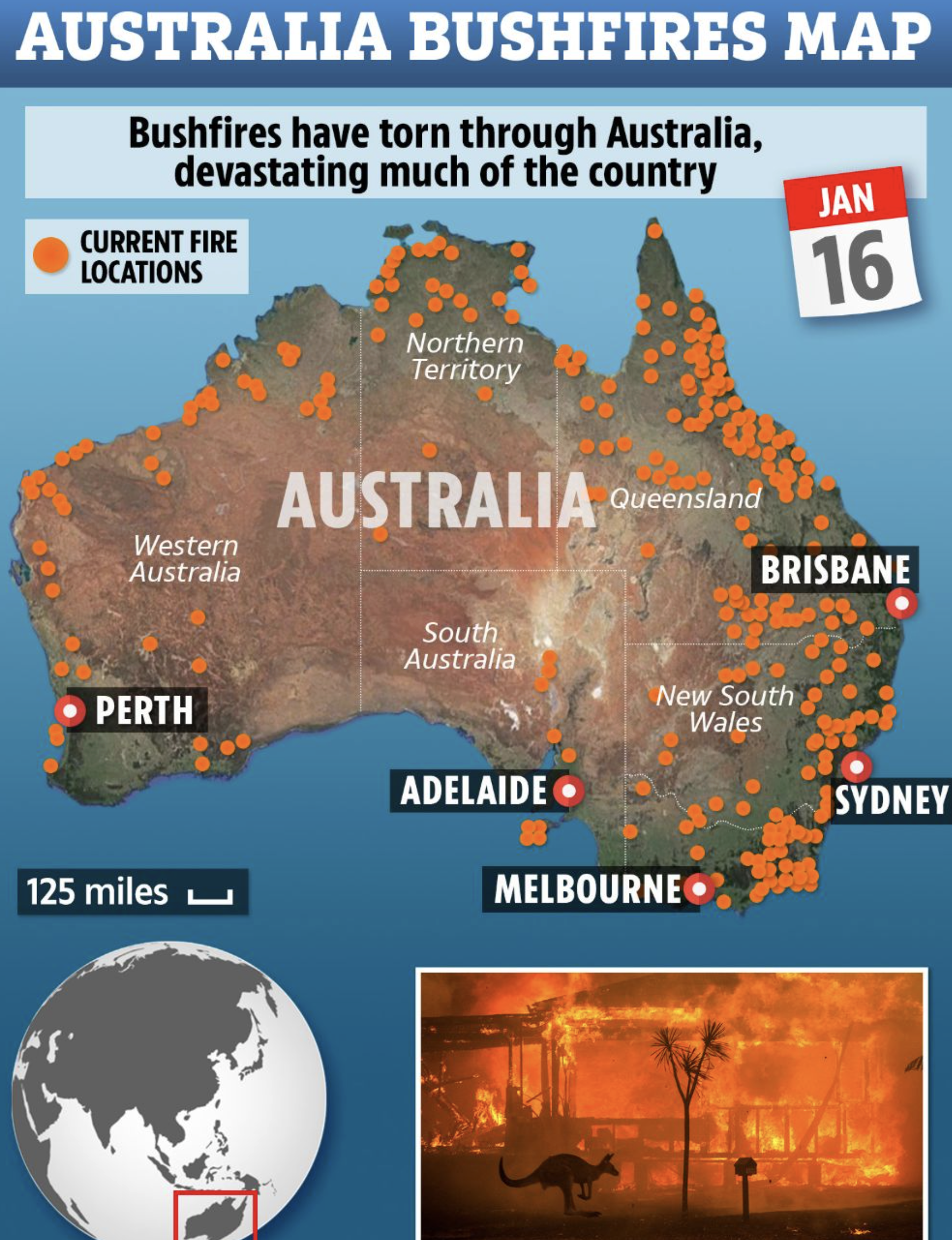

Lessons from Australia’s Most Costly Weather Events

—

From the 2011 Queensland floods to the 2022 East Coast storms, Australia’s most costly weather events have reshaped how insurers, governments, and households understand risk. Each catastrophe highlights gaps in preparedness, documentation, and insurance coverage. These gaps continue to cost Australians billions. Top 5 Costly Disasters (ICA Data 2025) Each event exposed major weaknesses in…

-

The Homeowner’s Annual Checklist: Stay Ahead of Repairs and Risks

—

A well-maintained home is cheaper and safer to insure. Following an annual home maintenance checklist reduces preventable damage and prevents insurers from reducing or denying payouts. Your yearly routine can be the best defence against costly, avoidable problems. Your Yearly Home Protection Checklist 1. Roof and Gutters – Clean every three months; replace cracked tiles.2.…

-

Why 1 in 3 NSW Homes Are Underinsured Against Flood and Storm Damage

—

When storms sweep across New South Wales, the financial impact often lingers long after the skies clear.A growing number of homeowners are discovering that their “comprehensive” home insurance doesn’t actually cover the full cost of rebuilding or replacing their possessions. The Scale of Underinsurance The Insurance Council of Australia (2025) estimates that one in three…

-

Understanding Your Home’s True Value (It’s More Than Just Property Price)

—

When most people think about what their home is worth, they focus on the market price. But understanding your home’s true value means looking at what it would actually cost to rebuild — and that number is often much higher. From an insurance perspective, failing to calculate real replacement costs can leave you dangerously underinsured.…

-

The Real Cost of Climate Change on Australian Home Insurance

—

Australia is facing more frequent natural disasters than ever, reshaping how insurers price risk. From floods to fires to hailstorms, climate change and home insurance are now inseparable — and the financial impact is growing. Premiums Rising Faster Than Inflation Data from the Actuaries Institute (2025) shows home insurance premiums have risen by 28% in…